The anatomy of the presource curse (poster)

KEY FINDINGS

The presource curse in Mozambique

- Natural resource exploitation is often associated with macroeconomic distortions due to Dutch Disease.

- In Mozambique major challenges have emerged in the discovery and development phases, years prior to actual production.

- Government debt stock (external + internal) rose from 64% of GDP in 2014 to over 120% of GDP in 2020 (graph 2).

- Real economic growth slumped from over seven per cent in 2011 to three per cent by 2017 & less than 0% by 2020 (graph 2)

DEFINITIONS, METHODOLOGY & EXPERIENCES

Definitions & methodology

The “presource curse” denotes the adverse effects resulting from the anticipation of forthcoming natural resource wealth.

It encompasses the time from resource discovery to its exploitation.

This poster presents data from previous IGM working papers predating gas exploration.

These are findings and warnings from authors who have studied natural resources and their effects on the economy.

The experience of coal

Coal projects by Rio Tinto and Vale in the Tete Province started operations in 2011

Coal projects were expected to contribute significantly to the country’s economy – e.g., IMF (2013) projected growth rates of over 8% 2013-2018. Coal is an example that high expectations can remain unfulfilled.

The experience of gas

Natural gas reserves were discovered in the early 2010s in Cabo Delgado;

In 2016 the IMF published very bullish projections (Graph 1) on revenue growth from LNG, with fiscal revenues from gas exceeding 10% of GDP from 2024;

Production was expected to start already from 2020 including on-shore and off-shore fields

In 2013, news surfaced regarding of undisclosed public-sector loans, totaling over US$2.3 billion, roughly equivalent to 20% of Mozambique’s GDP.

In 2019, the public debt stock as a percentage of GDP reached approximately 120%, and the growth rate, fell below 3%.

Due to financing pressures, public investment fell from 17% of GDP in 2013 to 7.1% of GDP in 2023.

Today, only one small off-shore field is operational and revenues from LNG are projected to be just 0.3% of GDP (less than 1% of what had been forecast in 2016).

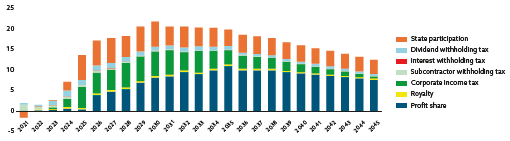

Graph 1:

2016 IMF’s Fiscal Revenues Projections from LNG Projects

Graph 2:

Economic Growth and Government Debt

POLICY OPTIONS

- Effective management of the expectations to avoid potential negative consequences.

- Avoidance of over-reliance on a specific sector or product, that is, diversifying the economy to minimize the effects of shocks in each given sector.

- Establishment of transparent and accountable fiscal policies to manage revenues from extractive industries.

- Involvement of local communities in decision-making processes related to resource extraction and making sure that they receive a fair share of the benefits.

REFERENCES

- WIDER Working Paper 2020/136 - Natural resources, institutions, and economic transformation in Mozambique

- Documento de Trabalho WIDER 2018/113 – What are the prospects for Mozambique to diversify its economy on the back of ‘local content’?

- Dietsche, E., & Esteves, M. (2020). Local Content and the Prospects for Economic Diversification in Mozambique. Em J. Page & F. Tarp (Eds.), Mining for Change (1.aed., pp.209–231). Oxford University Press Oxford. https://doi.org/10.1093/oso/9780198851172.003.0010

- Roe, A. R. & UNU-WIDER. (2018). Extractive industries and development: Lessons from international experience for Mozambique (56.a ed., Vol. 2018). UNU-WIDER.https://doi.org/10.35188/UNU-WIDER/2018/498-8Real

Download the poster here